Money is an essential aspect of our lives, and managing it effectively is crucial to achieving financial stability and freedom. Whether you’re just starting your journey to financial independence or are looking to improve your current financial situation, understanding the basics of money rules is essential. In this article, we’ll cover some of the fundamental principles of money management that can help you make better financial decisions and build a stronger financial foundation for your future. From budgeting and saving to investing and debt management, these rules will provide you with a solid framework to help you achieve your financial goals.

1. Nobody get rich by saving

Nobody becomes wealthy by merely saving money, which is a hard truth to accept. It’s a difficult thing to embrace, particularly given that we’re indoctrinated from an early age that saving is the key to accumulating riches.

The reality is that in the current economy, merely saving money is insufficient. Your savings aren’t growing in value over time; instead, they’re losing value due to inflation rates, stagnating income, and increased living expenses. Even if you are successful in saving a substantial sum of money, the interest rates on most savings accounts are so low that you barely make any money.

So what is the solution? Saving money is important, but it’s also important to invest it intelligently. Saving your money in a savings account can result in much lower returns than investing it in stocks, real estate, or other assets. Investment can, of course, come with risks, so it’s critical to do your research and make intelligent decisions.

But the reality is that creating wealth demands for a lot more than simply saving and investing. It demands effort, commitment, and sometimes a great deal of luck. It’s about looking for chances, taking a risk, and capitalizing any opportunity you have to succeed.

2. Know difference between assets and liabilities

When it comes to building wealth, You should know the difference between Assets and liabilities. It can be a game-changer for you. Yet, a lot of people have trouble with it. So let’s break it down

An asset is things that you own and it has a store value. This could be anything, such as real estate, stocks, or a priceless work of art. In general, assets are things that have appreciation value over time, which means it can help you in creating wealth.

Liabilities are the debts or financial responsibilities that an individual owes to other people. Credit card debt, personal loans, mortgages, auto loans, and student loans can all fall under this category.

So be careful to before you spend too much on your liability. It is a destroyer of your wealth.

Furthermore, understanding the relationship between assets and liabilities can also help you make better financial decisions in your personal lives, such as purchasing a home, buying a car, or taking out a loan. You can make better decisions that can result in long-term financial stability and prosperity by knowing how these actions affect their total financial status.

3. Make Tax work For you

Taxes can be a significant expense for individuals like you. So you must learn how to make taxes work for you and potentially reduce the amount you owe. You can smartly use the stated ways to reduce your taxes and use that money to work for you to generate wealth. You can take advantage of tax deductions and credits and contribute to a retirement account. You can also invest in tax-efficient funds. You can take help from a qualified tax professional who assists you in developing a tax strategy that works for you. By doing so, you can potentially reduce the amount of tax you owe and maximize your financial situation.

4. Learn How to Use other People money

Learning how to use other people’s money to create wealth is a crucial skill for anyone who wants to build wealth and achieve financial independence. By leveraging other people’s money, you can maximize your investment potential and generate higher returns than you would on your own. However, this strategy requires careful planning, a solid understanding of financial markets, and a willingness to take calculated risks.

5. You need to earn more, not spend less

Focusing on earning more, rather than spending less, can be a more effective way to achieve financial success. While cutting expenses is important, there’s a limit to how much you can reduce your expenses. On the other hand, there’s no limit to how much you can earn. By increasing your income, you can achieve your financial goals faster, invest in yourself, live a more fulfilling life, and give back to others. Earning more can also provide more opportunities to improve your financial situation, compared to solely cutting expenses. So, to take control of your finances and reach your goals, consider focusing on earning more.

6. Make Money while you sleep

Making money while you sleep may seem like a dream, but it is possible with passive income streams. With passive income, you can earn money with little or no effort with passive income. You must create passive income streams to gain wealth. You can invest in stocks or rental properties and create digital products. You can also invest in various potential start-ups or businesses. You need to build a solid foundation by starting with a savings plan, paying off debt, and establishing an emergency fund. Once you have a solid financial foundation, you can start building your passive income streams and watch your money work for you, even when you’re not actively working.

7. Learn to Budget your income

Creating a budget is an important part of managing your finances. To create a budget for your monthly income, start by determining your total monthly income after taxes and deductions. Then, list your monthly expenses and categorize them into essential and discretionary expenses. Prioritize your essential expenses, allocate funds for your savings goal, and then allocate the remaining funds towards your discretionary expenses. Keep track of your spending throughout the month to ensure that you are staying within your budget. Review your budget regularly and make adjustments as necessary. Remember, creating a budget takes effort, but it’s a crucial step towards achieving your financial goals.

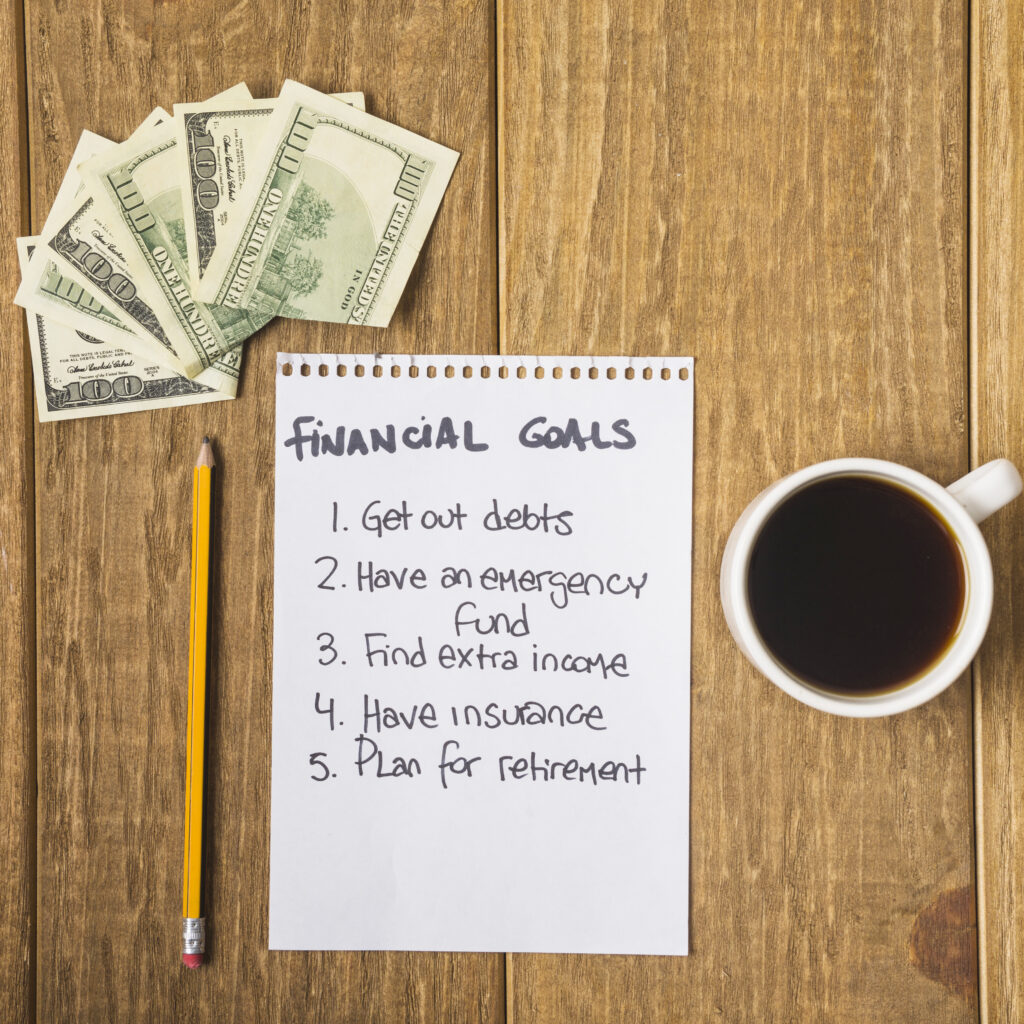

8. Have a Retirement Plan

Retirement planning is an important aspect of financial planning. It involves setting aside money for your future so that you can enjoy your golden years without financial worries. Start by identifying your retirement goals and determining how much money you will need to achieve them. Consider factors such as healthcare costs and inflation. Then, determine how much you need to save each month and create a budget to achieve that goal. Invest in retirement accounts such as 401(k)s or IRAs, and diversify your investments to mitigate risk. Regularly review and adjust your retirement plan as necessary. Remember, starting early and being consistent with your savings can make a significant difference in your retirement funds.

9. Have insurance

Insurance is a critical aspect of financial planning because it provides protection against unforeseen events that can significantly impact your finances. There are several types of insurance, including health insurance, life insurance, disability insurance, homeowners/renters insurance, and auto insurance. Health insurance protects you from high medical costs, while life insurance provides financial protection to your loved ones in the event of your unexpected death. Disability insurance offers financial support if you become unable to work due to a disability. Homeowners, renters, and auto insurance protect against property damage or loss. Having insurance can provide peace of mind and help you maintain your financial stability in the face of unexpected events. It’s essential to evaluate your insurance needs and choose policies that provide sufficient coverage at a reasonable cost.

In conclusion, mastering the basics of money management is essential to achieving financial stability and freedom. By following these 9 rules for money management, you can take control of your finances and build a stronger financial foundation for your future. From creating a budget and sticking to it, to saving regularly and investing wisely, these principles will help you make better financial decisions and achieve your financial goals. Remember, financial success is a journey, not a destination, and by staying disciplined and committed to these rules, you can create a brighter financial future for yourself and your loved ones. Start implementing these principles today and watch as your finances begin to thrive.